maryland electric vehicle tax incentive

Up to 4000 rebate for new electric vehicles must be ordered purchased or leased after July 25 2022 with a MSRP under 55000. Learn More About BMW Electric Vehicles Now.

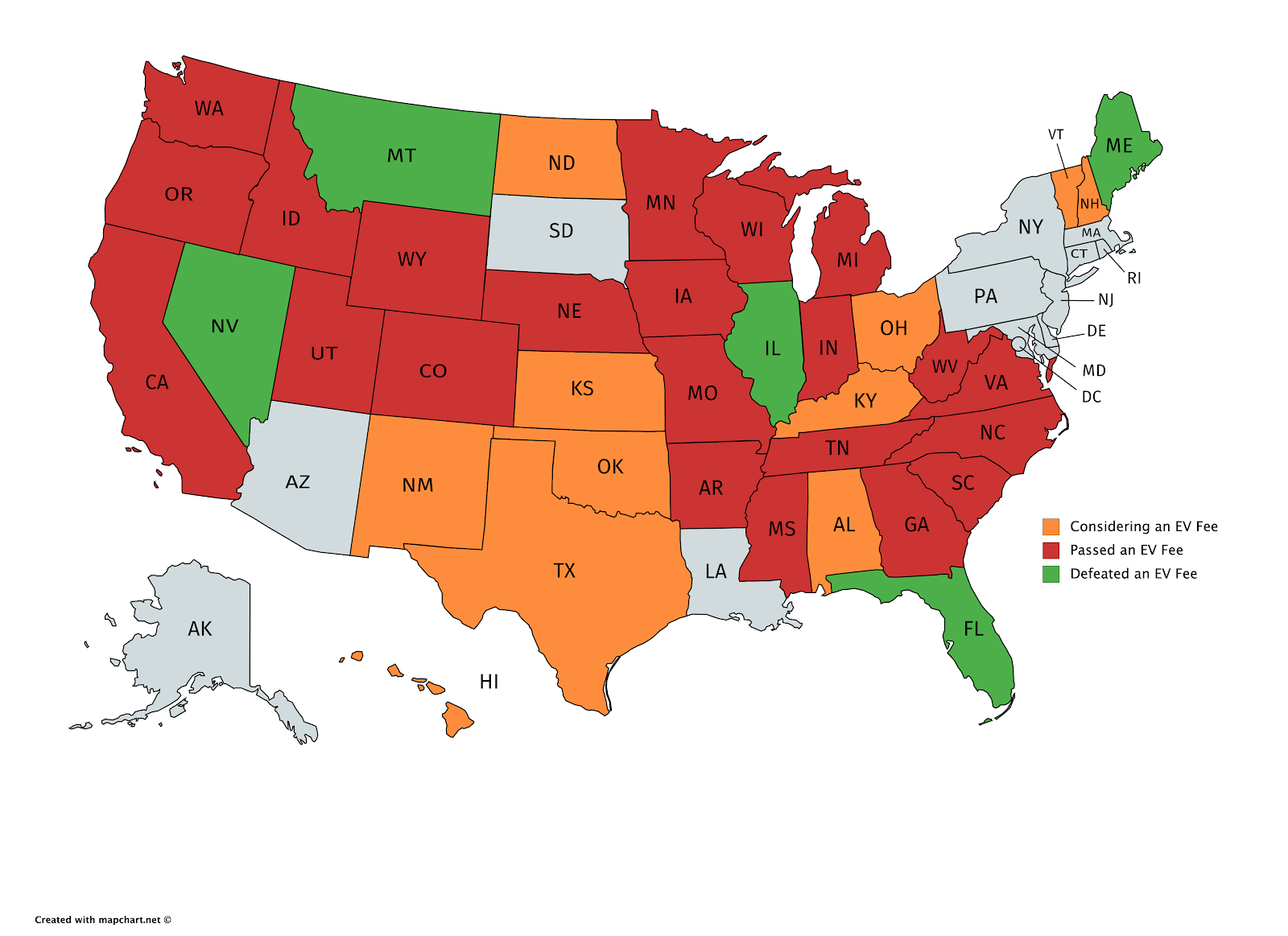

Don T Be Fooled Annual Fees On Electric Vehicle Drivers Are Not Fair Sierra Club

The tax break is also good for up to 10 company vehicles.

. Luxury Performance in Perfect Harmony. The credit ranges from 150 to 3000 depending on the vehicles battery size the larger the. Funding is currently depleted for this Fiscal Year.

Maryland offers individuals who purchase or lease a qualifying plug-in electric vehicle a one-time excise PEV tax credit of up to 3000 while funds last. The rebate is up to 700 for. Internal Revenue Code Section 30D IRC 30D introduced a credit for Qualified Plug-in Electric Drive Motor Vehicles that includes passenger vehicles and light trucks.

The EVSE Rebate Program aims to reduce the financial burden of acquiring andor installing charging stations and to increase EV. The Maryland electric vehicle incentive EVsmart can help you to save 300 on your electric or plug-in hybrid electric vehicle expenses. This credit is applicable for vehicles acquired after December 31 2009 amounting to 2500 plus 417 for.

Maryland EV Tax Credit Extension Proposed in Clean Cars Act of 2021. Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in Hybrid. Clean Fuels Incentive Program CFIP Reduces consumption of imported petroleum by providing incentives for both publicly accessible alternative fuel infrastructure and alternative fuel fleet vehicles.

Receive federal income tax credits for the installation of alternative fuel systems. January 5 2021 Lanny. State Incentives Electric Vehicle EV Corridor Charging Grant.

Purchasers were encouraged to file a form to reserve a place in the. Through the programs below MEA helps Maryland residents businesses non-profits and local governments implement energy efficiency upgrades. Marylands state electric vehicle tax credit program has proven so popular that rebate funding was depleted for the entire fiscal year.

5 rows The credit is for 10 of the cost of the qualified vehicle up to 2500. SMECO Energy Rates August 2022 Residential. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid.

The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids. Ad Check Out the Kia Electric Vehicle Lineup. The Maryland Energy Administration MEA manages grants loans rebates and tax incentives designed to help attain Maryla nds Goals in energy reduction renewable energy climate action and green jobs.

The Electric Vehicle Supply Equipment EVSE Rebate Program provides funding assistance for costs incurred acquiring andor installing qualified EV supply equipment also referred to as charging stations. EV and hybrid vehicle purchase incentives do benefit from some bipartisan support in Maryland and throughout the country. 10 discount on off-peak toll prices on NJT and GSP through EZ-Pass.

Fuel Production or Quality. The Maryland Office of the Comptroller has determined that based on IRS rules a State voucher is considered taxable income related to the Motor Carrier or Manufacturer as it relates to leased vehicles. Youve Never Met a Vehicle that Looks or Drives Like this.

Beginning July 1 2023 qualified EV and FCEV purchasers may apply for an excise tax credit of up to 3000. Utility companies Pepco Potomac Edison Baltimore Gas and Electric BGE and Delmarva Power have each partnered with the state government to offer a 300 rebate for purchasing and installing an approved level 2 smart. The tax credit is first-come first-served and is limited to one vehicle per individual and 10 vehicles per business entity.

Effective July 1 2023 through June 30 2027 an individual may be entitled to receive an excise tax credit on a qualifying zero-emission plug-in electric or fuel cell electric vehicle regardless of whether you own or. You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle. Electric Vehicle EV and Fuel Cell Electric Vehicle FCEV Tax Credit.

Federal EV Tax Credit. Alternative Fuels Tax Credit. Yes there is a Maryland EV tax credit for electric vehicles as well as a home charger rebate incentive.

Therefore a Form 1099-G will be issued for vouchers received through the Maryland Electric Truck MET Voucher Program. Maryland Zero Emission - Electric Vehicle Infrastructure Council. Even local businesses get a break if they qualify.

ECPG funding is available for. For more information. The Maryland Department of Environment MDE offers grants of up to 80 of the cost for the installation of direct current fast charging DCFC stations along Federal Highway Administration designated alternative fuel corridors through the Electric Corridors Grant Program ECGP.

Ad The Electric Side of BMW. The tax credit is available for all electric vehicles regardless of make or model and can be used to purchase the vehicle or lease it. Maryland offers a rebate of 40 of the cost of Electric Vehicle Charging Equipment and Installation.

Say Goodbye to Gas Stations with the 2022 Chevy Bolt EV. The Maryland electric vehicle incentive EVsmart can help you to save 300 on your electric or plug-in hybrid electric vehicle expenses. Maryland EV Tax Credit Incentives to Help You Save Big.

Maryland EV Tax Credit. Kias Vehicle Lineup has Collected Top Safety and Quality Awards. Some dealers may offer additional incentives.

Compare Models and Find Your Perfect Match. Federal and State Tax Incentives for Electric Vehicles in Pennsylvania and Maryland. Electric Vehicles Solar and Energy Storage.

Federal Electric Car Incentive. Tax Status of Electric Truck Vouchers. Renewable Fuel Standard or Mandate.

Marylanders who purchased a plug-in electric vehicle since funds were depleted for the 3000 state excise tax credit have been waiting to see if the legislature will reauthorize funding for the program.

Buy An Electric Car And Save Bankrate

Tazzari Zero Production Electric Microcar Made In Italy 20 300 Electric Cars Microcar Car

Electric Car Tax Credit What Is Form 8834 Turbotax Tax Tips Videos

The Surge Of Electric Vehicles In United States Cities International Council On Clean Transportation

Five Things To Look For In Buying An Electric Vehicle For Below 50k The Hill

How Do Electric Car Tax Credits Work Kelley Blue Book

Governors Start 2022 With A Focus On Electric And Alternative Fuel Vehicles And Networks National Governors Association

Get A Tax Credit For Buying An Electric Vehicle Updated List 2023

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Are Michigan S Registration Fees On Electric Vehicles Causing It To Fall Behind Other States

Electric Vehicle Charger Installation

U S Senate Panel Wants To Raise Ev Tax Credit As High As 12 500

Comparison Of Electric Vehicle Charging Infrastructure Per Million Download Scientific Diagram

China Electric Vehicles Ride Unstoppable Momentum Energy Intelligence

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

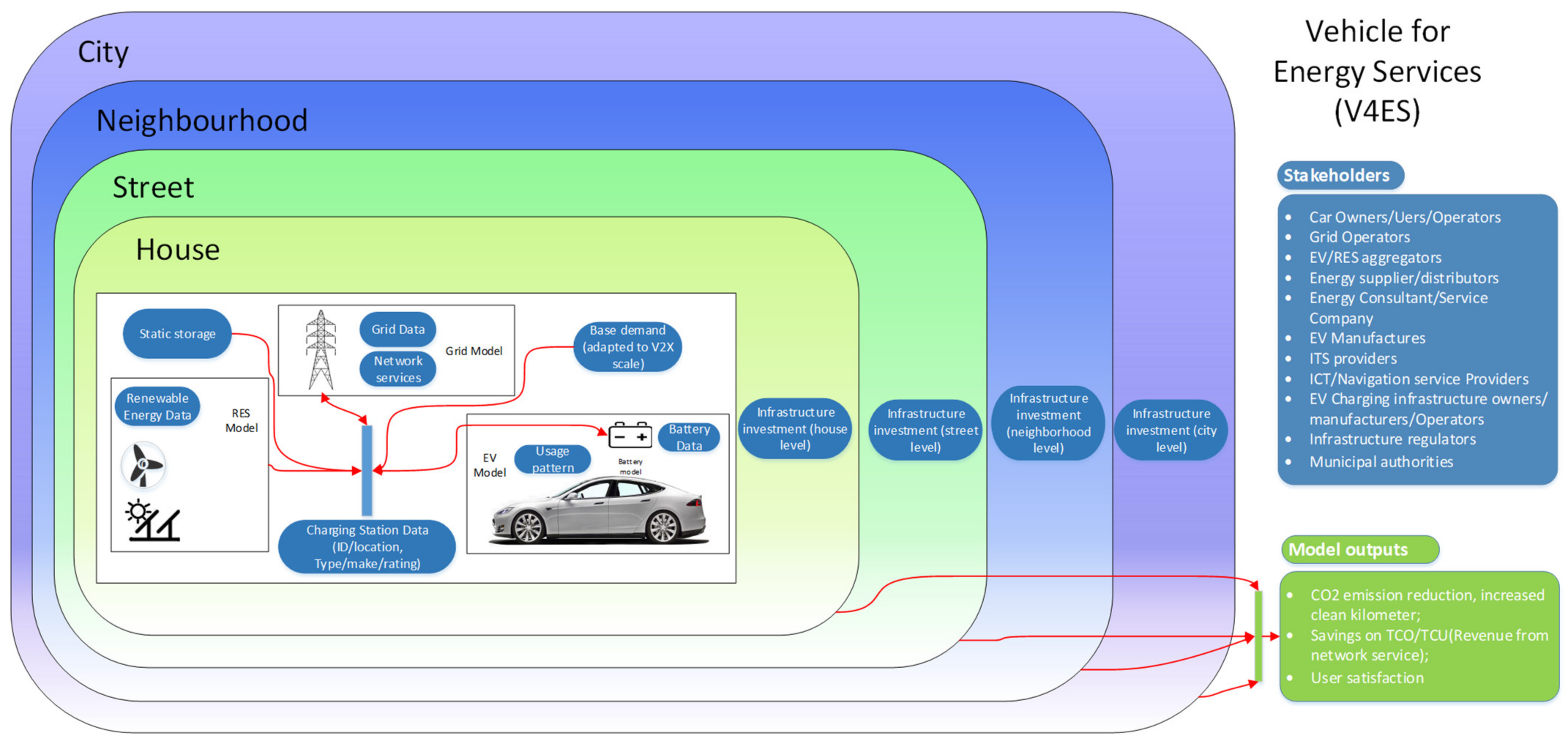

Sustainability Free Full Text Framing Electric Mobility For Urban Sustainability In A Circular Economy Context An Overview Of The Literature Html